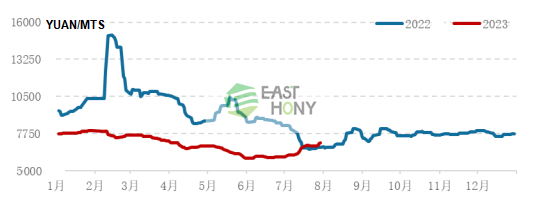

Melamine Monthly Review- Narrow Market Volatility July 2023

1. Market review of the month

In July, China melamine market showed an overall upward trend. The average EXW price turns an increase of 606 yuan/ton or 10.09% compared to the previous month’s average price,

At the beginning of this month, the price was relatively low. With the stabilization of the market, some downstream companies followed up on bargains and saw an improvement in their order taking and shipment situation.

As a result, with the continuous prices increase of raw material urea , the cost support manufacturers’ willingness to increase prices significantly increased, leading to continuous exploration of price increases.

As the demand side was in the traditional off-season of consumption, there was resistance from downstream towards high prices, and the upward trend of urea also slowed down. Local transactions were slightly loose, and the fundamentals were not good enough to boost prices. Prices continued to rise weakly, and companies reported relatively strong prices with many pending orders. As the end of the month approaches, urea has stopped falling and rebounded, with a significant increase, once again forming a certain cost pull on melamine, and some companies have raised their prices accordingly.

2. Market analysis forecast for next month

From the perspective of raw materials, there is room for a downward trend in the urea market in the later stage, but the expected magnitude may be limited, and the overall market may remain at a high level of volatility. Therefore, it will continue to form a certain cost support for melamine.

From a supply perspective, some enterprises have maintenance plans in the later stage, but there are still production stoppages or recovery plans, and new devices may be put into operation. The overall operating load level of the enterprise may be relatively high, and the supply of goods is relatively stable.

From a demand perspective, downstream demand may still be relatively weak in August, and in the later stages, with the arrival of the traditional “Golden Nine Silver Ten” consumption peak season, the overall operating situation of downstream factories may improve, which will also form strong support for the market.

Remark: The analysis is based on transaction in China’s domestic market, it’s only for reference.

Contact information: melamine@easthony.com